Denny Fisher

Dragon Knight

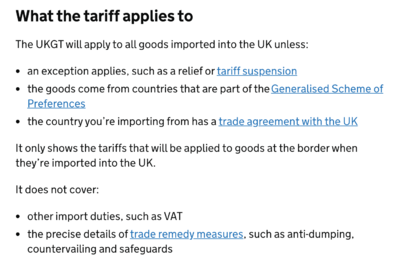

Is that actually happening though.Guess we'll have to deal with this upcoming change to shipping for UK consumers as signs show that companies will have to pay for VAT upfront to the UK come January 1st (and items under £15 will be no longer exempt from VAT). Seeing some stores already saying nope to this is concerning especially for non amazon (who of course already do this) companies who additional costs for a likely small market (I wonder if Right Stuf, JB Hi Fi and plenty of others will just close sales to the UK due to the costs and reduced profits). This is basically all bad, and it's all being done in attempt to save time with customs checks.

Didn't the UK want to have free trade deals and lower vat so they can under cut the EU?

So that £15 limit might actually go up.