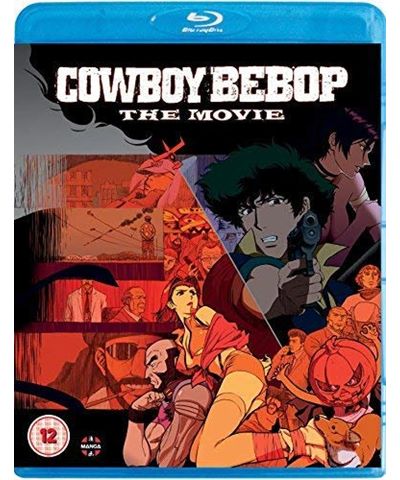

I don't know how to contact the Funimation UK retail (not digital) support department so if anyone has an email it would really help me.

But I have contacted both Anime-On-Line and Amazon UK and today I got the following answers.

Anime-On-Line replied and I quote:

"We are aware of the European selling issue with some of the newer titles on Amazon which we are currently working through."

Amazon replied among others that the issue is because and I quote:

"The item(Anime Blu-Ray) are not supported for UK to GR export due to missing country of origin information. This is an intentional blocker on selection with unclear origins."

I don't know why Anime-On-Lines Blu-Rays have a missing country of origin and how that could be fixed though.

The Amazon message continues with and I quote:

"To help you out in this issue, I've once again forwarded it to the relevant team and informed them to remove the sales restrictions as soon as possible. Once the restriction has been removed, you can be able to place the items without any issues."

They have told me similar things a couple of times before and unfortunately nothing seems to change.

But I have contacted both Anime-On-Line and Amazon UK and today I got the following answers.

Anime-On-Line replied and I quote:

"We are aware of the European selling issue with some of the newer titles on Amazon which we are currently working through."

Amazon replied among others that the issue is because and I quote:

"The item(Anime Blu-Ray) are not supported for UK to GR export due to missing country of origin information. This is an intentional blocker on selection with unclear origins."

I don't know why Anime-On-Lines Blu-Rays have a missing country of origin and how that could be fixed though.

The Amazon message continues with and I quote:

"To help you out in this issue, I've once again forwarded it to the relevant team and informed them to remove the sales restrictions as soon as possible. Once the restriction has been removed, you can be able to place the items without any issues."

They have told me similar things a couple of times before and unfortunately nothing seems to change.