Lordhippos

Pokémon Master

I know this is a weird topic for an anime forum but if I help one person out it's worth it!

I've always considered myself somewhat financially savvy, but I've come to realise that I should have been doing things differently for the past decade or so. I want to help other people avoid my mistakes. I'm working to correct my own setup as of today.

I am not a financial advisor so any recommendations here are just opinions

TLDR of what I was doing wrong:

There is a good video worth watching in the spoiler tag here that covers this. The guy is a bit marmite, so you may dislike his character, but I think he's absolutely right in what he's saying in terms of what people should be doing depending on their circumstances.

Too many people just throw their savings into a low interest current account and then forget about it, rather than putting their money to work.

I'm not going to re-word everything he says here, the order of priority items is covered pretty well. I'll cover some of my key recommendations though based on this.

The rest of what I'm going to say here assumes you have paid off any high-interest debt that is costing you a lot to service, after all not paying interest in the first place is the best first step towards accrual of savings.

Pension Match

The obvious one people often miss is that some employers offer better than usual pension matching schemes. It's worth checking if you are able to get access to a better workplace pension setup than you may have today.

Current full time employer workplace pension schemes at a minimum see you pay in 5% and your employer 3% for a total salary pension contribution of 8%. Source

If your employer offers a better matching rate than this, i.e. they match your contribution to say 8%, then this is the single best investment you can make. This is effectively 50% free money and will beat any other investment.

Pension Funds

How many people hear the term Pension and they immediately go into zombie mode? It's not the most interesting topic.

Have you checked yours lately? How is it doing?

I was shocked when I checked mine and saw how poorly it was performing. I've had a workplace pension since 2007 but it's barely made any profit, I would have been better off in cash savings accounts probably. I basically ignored the pension and it's performance for many years. I have more in savings than my Pension!

What am I doing instead? I've moved my investments (largely) over to global trackers within the workplace pension. These are pension funds that are wrappers for multiple global companies and markets. It means I don't need to think about it, just invest into these and let it run. I figure I can't second guess the whole world!

Stock Market

I always thought of the stock market as sort of gambling, but in reality I think using the global tracker funds (or similar investments) is the only way you can turn some money into a lot of money long term via compounding effect. Cash in a savings account will never grow at insane levels.

Stock Markets have averaged 9-10% per year for the last 100 years or so back tested.

Stocks can go up or down but the general trend is up long term, if you can weather any storms.

If you are able to save some money each month, I'd recommend setting up a direct debit that automatically buys into these funds in some fashion. Which one you use may depend on your circumstances but you can essentially buy the same thing in one of 3 main ways:

Even doing £100 per month into S&S ISA or SIPP would be better than doing £0, which is what I was doing.

Dollar Cost Averaging (DCA)

This is a strategy where you just buy something monthly without concern for short term movements. This is good for various reasons, but the main ones are:

Over-paying mortgage

Whilst I do think it's worth over-paying this a bit, I don't think it's worth throwing all of your money at it, if you have options then I'd do a combined-arms approach, some into regular overpayments, some into S&S ISA/SIPP.

This assumes no other debt, as other debt is likely going to cost more than a mortgage on a % basis.

I have overpaid far too much and in reality I should have been investing more into the stock markets instead.

Which funds to look at

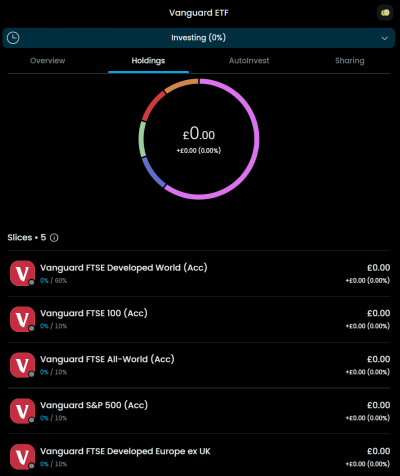

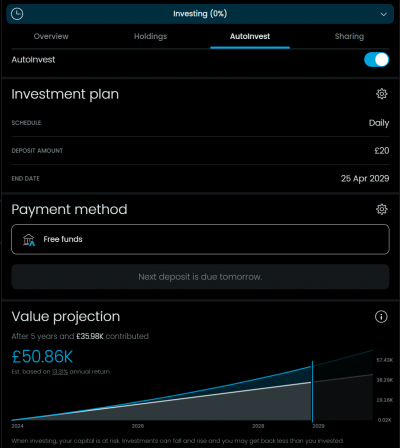

I like to keep things simple, so I have opened up a Vanguard account and created a SIPP and a S&S ISA within it. This isn't a plug for Vanguard, you can do this with other brokers (this would be a do your own research type deal!). I don't get any bonus or referrals for recommending Vanguard over others, it's just one I'm using as the fees are reasonable!

Most of my funds are going into VHVG (70%+) but I will be putting some into the others I've listed here. You could keep it really simple and put 100% into VHVG.

VHVG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VUAG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VAFTIGA - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VERG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

Note: The ones labelled ETF you can only buy in multiples of 1, so in the case of VHVG 1 unit costs about £80, so you can't invest less than that each month into auto-buying it. The unit trust one VAFTIGA allows for splitting but I don't recommend going into that 100% as it's too UK focused.

Fees

Whether in S&S ISA, SIPP, or Pension, these funds have fees. In the case of VHVG it's a platform fee of 0.15% and then the fund costs 0.12% ongoing, so expect a fee of around 0.27% annually based on how much you have invested. Some of the others had less fees but none are free. This is typical, and performance should still out-pace the fees.

You can configure Vanguard to direct debit the fees from your account to avoid selling investments to cover them, I think this is the best idea, though expect fees to be taken periodically in this way.

Monthly split of funds

My outcome of all of this is that I essentially have money I can allocate each month, and I'll adjust the values as I go along. I'll probably re-balance this approach yearly.

Once I get paid, I'm currently allocating things this way for fiscal year (April - April) 2024 - 2025:

Mortgage Overpayment: £0

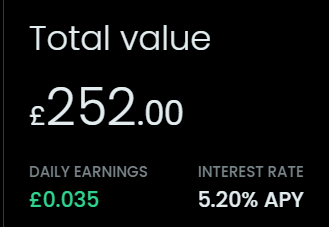

Regular Saver (8% interest) with Nationwide: £200

Vanguard SIPP: £50

Vanguard S&S ISA: £500

Cash ISA (ZOPA 5.08% easy access): £250

Total £1000

£1000 sounds like a lot, but I can do it as my day to day expenses are fairly low, and my mortgage is less than £500 pcm, so I have a good deal of disposable income. I am not in the higher earner category though wage is OK, so this kind of thing isn't totally impossible!

This strategy works with smaller sums though. SIPP figure is just a nod to getting this started more than anything. I've transferred a couple of my old workplace pensions over to the Vanguard SIPP.

Going into 2025 - 2026 I'll likely reduce cash ISA and increase S&S ISA instead, I just wanted a certain figure in the cash ISA first. I may also increase the SIPP a little up to say £100.

2026 - 2027 I'll definitely be adding some mortgage over payment here, even if it's only £1-200 per month.

Questions/Comments

Ask away!

I've always considered myself somewhat financially savvy, but I've come to realise that I should have been doing things differently for the past decade or so. I want to help other people avoid my mistakes. I'm working to correct my own setup as of today.

I am not a financial advisor so any recommendations here are just opinions

TLDR of what I was doing wrong:

- Over paying the mortgage far too much vs other investments.

- Not investing into global trackers either via workplace Pension/SIPP (Self Invested Pension) or S&S (Stocks and Shares) ISA.

- Not paying attention to my pension at all.

- Invest in Global Tracker funds via your investment vehicle of choice, make it a routine monthly thing for whatever sum you are comfortable with.

- Make sure your pension is matched to the best your employer can offer.

There is a good video worth watching in the spoiler tag here that covers this. The guy is a bit marmite, so you may dislike his character, but I think he's absolutely right in what he's saying in terms of what people should be doing depending on their circumstances.

Too many people just throw their savings into a low interest current account and then forget about it, rather than putting their money to work.

The first 9 mins of this video will cover basics pretty well.

I'm not going to re-word everything he says here, the order of priority items is covered pretty well. I'll cover some of my key recommendations though based on this.

The rest of what I'm going to say here assumes you have paid off any high-interest debt that is costing you a lot to service, after all not paying interest in the first place is the best first step towards accrual of savings.

Pension Match

The obvious one people often miss is that some employers offer better than usual pension matching schemes. It's worth checking if you are able to get access to a better workplace pension setup than you may have today.

Current full time employer workplace pension schemes at a minimum see you pay in 5% and your employer 3% for a total salary pension contribution of 8%. Source

If your employer offers a better matching rate than this, i.e. they match your contribution to say 8%, then this is the single best investment you can make. This is effectively 50% free money and will beat any other investment.

Pension Funds

How many people hear the term Pension and they immediately go into zombie mode? It's not the most interesting topic.

Have you checked yours lately? How is it doing?

I was shocked when I checked mine and saw how poorly it was performing. I've had a workplace pension since 2007 but it's barely made any profit, I would have been better off in cash savings accounts probably. I basically ignored the pension and it's performance for many years. I have more in savings than my Pension!

What am I doing instead? I've moved my investments (largely) over to global trackers within the workplace pension. These are pension funds that are wrappers for multiple global companies and markets. It means I don't need to think about it, just invest into these and let it run. I figure I can't second guess the whole world!

Stock Market

I always thought of the stock market as sort of gambling, but in reality I think using the global tracker funds (or similar investments) is the only way you can turn some money into a lot of money long term via compounding effect. Cash in a savings account will never grow at insane levels.

Stock Markets have averaged 9-10% per year for the last 100 years or so back tested.

Stocks can go up or down but the general trend is up long term, if you can weather any storms.

If you are able to save some money each month, I'd recommend setting up a direct debit that automatically buys into these funds in some fashion. Which one you use may depend on your circumstances but you can essentially buy the same thing in one of 3 main ways:

- Stocks and Shares ISA

- £20K per annum limit shared with Cash ISA allowance.

- Any gains are tax free.

- Short term access if you require the funds, though it's best to put money here you don't need back short term.

- SIPP

- This is your own self-managed pension fund.

- Long term lock.

- Workplace Pension

- Where your employer pension goes.

- Long term lock.

Even doing £100 per month into S&S ISA or SIPP would be better than doing £0, which is what I was doing.

Dollar Cost Averaging (DCA)

This is a strategy where you just buy something monthly without concern for short term movements. This is good for various reasons, but the main ones are:

- Repeat investment without logic or reason playing any part of it.

- Your price paid averages up or down as time moves along, so you don't have to worry about timing your buy price.

- No stress saving for the future.

- You can do this with smaller sums and it's still worth doing.

Over-paying mortgage

Whilst I do think it's worth over-paying this a bit, I don't think it's worth throwing all of your money at it, if you have options then I'd do a combined-arms approach, some into regular overpayments, some into S&S ISA/SIPP.

This assumes no other debt, as other debt is likely going to cost more than a mortgage on a % basis.

I have overpaid far too much and in reality I should have been investing more into the stock markets instead.

Which funds to look at

I like to keep things simple, so I have opened up a Vanguard account and created a SIPP and a S&S ISA within it. This isn't a plug for Vanguard, you can do this with other brokers (this would be a do your own research type deal!). I don't get any bonus or referrals for recommending Vanguard over others, it's just one I'm using as the fees are reasonable!

Most of my funds are going into VHVG (70%+) but I will be putting some into the others I've listed here. You could keep it really simple and put 100% into VHVG.

VHVG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VUAG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VAFTIGA - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

VERG - Vanguard Asset Management | Personal Investing in the UK | Vanguard UK Investor

Note: The ones labelled ETF you can only buy in multiples of 1, so in the case of VHVG 1 unit costs about £80, so you can't invest less than that each month into auto-buying it. The unit trust one VAFTIGA allows for splitting but I don't recommend going into that 100% as it's too UK focused.

Fees

Whether in S&S ISA, SIPP, or Pension, these funds have fees. In the case of VHVG it's a platform fee of 0.15% and then the fund costs 0.12% ongoing, so expect a fee of around 0.27% annually based on how much you have invested. Some of the others had less fees but none are free. This is typical, and performance should still out-pace the fees.

You can configure Vanguard to direct debit the fees from your account to avoid selling investments to cover them, I think this is the best idea, though expect fees to be taken periodically in this way.

Monthly split of funds

My outcome of all of this is that I essentially have money I can allocate each month, and I'll adjust the values as I go along. I'll probably re-balance this approach yearly.

Once I get paid, I'm currently allocating things this way for fiscal year (April - April) 2024 - 2025:

Mortgage Overpayment: £0

Regular Saver (8% interest) with Nationwide: £200

Vanguard SIPP: £50

Vanguard S&S ISA: £500

Cash ISA (ZOPA 5.08% easy access): £250

Total £1000

£1000 sounds like a lot, but I can do it as my day to day expenses are fairly low, and my mortgage is less than £500 pcm, so I have a good deal of disposable income. I am not in the higher earner category though wage is OK, so this kind of thing isn't totally impossible!

This strategy works with smaller sums though. SIPP figure is just a nod to getting this started more than anything. I've transferred a couple of my old workplace pensions over to the Vanguard SIPP.

Going into 2025 - 2026 I'll likely reduce cash ISA and increase S&S ISA instead, I just wanted a certain figure in the cash ISA first. I may also increase the SIPP a little up to say £100.

2026 - 2027 I'll definitely be adding some mortgage over payment here, even if it's only £1-200 per month.

Questions/Comments

Ask away!

Last edited: